Loans in Belgium explained

Belgium is often regarded as one of the costliest countries in continental Europe. Most of the time, it is seen that people who travel to the nation have difficulty in finding a loan for their expenses.

However, not many of us know that understanding money matters in Belgium can be slightly tricky as an expat. From opening a bank account to finding a loan, it is essential to know which of the options are right for you. So, let us now check out the common types of loans in Belgium.

Loan providers in Belgium

So, what are the best loan providers in Belgium and which of them offers the best terms and conditions? We have listed below the most frequently used providers in Belgium.

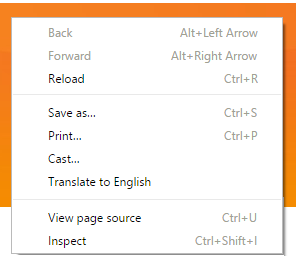

If you land on the website of a loan provider company (which is often in Belgian), make a right mouse-click anywhere on the page (this only works with Google Chrome!). A small dropdown menu will appear, and then it will say; “translate this page to English” (or any other language). This will make it better understandable and easier for you to make the right decision.

If you land on the website of a loan provider company (which is often in Belgian), make a right mouse-click anywhere on the page (this only works with Google Chrome!). A small dropdown menu will appear, and then it will say; “translate this page to English” (or any other language). This will make it better understandable and easier for you to make the right decision.Be aware that Borrowing money costs money

| Cheap | Good Terms | Low Interest rate | |

|---|---|---|---|

| Santander | ✓ | ✓ | ✓ |

| Mozzeno | ✓ | ✓ | ✓ |

| KBC | ✓ | ✓ | ✓ |

| Cofidis | ✓ | ✓ | ✘ |

| Medirect | ✘ | ✓ | ✘ | Finday | ✘ | ✓ | ✓ |

Why choose for a loan in Belgium

Are you living in Belgium and want to opt for a loan anytime soon? If your answer is yes, you have come to the right place. Here we have discussed a few reasons why you can also opt for a loan in Belgium. Have a look at them.

- You can opt for a loan for combined pricing credit card balances. In this way, you can simplify multiple bills into one, reduce interest charges, and improve your credit score.

- A loan in Belgium can be taken for emergency purposes, like buying a home appliance, paying medical bills, covering funeral expenses, etc.

- You can also take a loan for personal events, like a marriage ceremony, and more.

- You can opt for a personal loan for buying a vehicle, a home, and other things.

Along with the country has also mastered digital banking payments and mobile banking systems. Now let us see what the different types of loans that can be secured in Belgium are.

1. Personal Loan:

A personal loan is a type of loan borrowed for individual needs and not for business expenses. It is a sum of money that is taken for accomplishing personal needs. The reasons for borrowing a personal loan can be many and range from a new vehicle, study expenses and home loans.

Almost all personal loans work on promissory notes, which means the borrower, has to pay back the amount in a stipulated time.

2. Student Loan Belgium

As the name suggests, a student loan is a sum of money used by aspirants who would like to move their career forward. Not every young blood out there is born with a silver spoon. There are many for whom money becomes a significant hurdle for their dreams.

This is here where student loans come into the picture. The particular sum of money helps you manage college costs, including fees, daily expenses, and tuition fees. Belgium is often regarded as one of the countries which offer the best loans for students.

3. Car Loan Belgium

Car loans are the types of loans that are provided to the customers for purchasing a new car. In Belgium, even the used cars are financed with the help of unsecured loans. However, if you are up for buying a new car, then it can be done with the help of secured loans.

When you try to look for options in Belgium for car loans, there are many to take note of. Financial institutions like Beobank, CBC Banque, KBC Bank, Bpost Bank, and Cetelum offer car loans at a reasonable interest rate. Another plus point of these institutes is that they help settle the amount in 2 years, which resonates with the users.

4. Bank Loans in Belgium

Bank loans in Belgium are bifurcated into two categories, namely unsecured and secured loans. The fundamental difference between these two is that unsecured consumer loans are not backed by collateral and have a higher interest rate.

There are in total over 12 banks in Belgium that offer bank loans to consumers. The borrowing rates vary between 3.49%-12.50%, and the loan terms are between 6-120 months.

5. Home Loan Belgium

Home Loans or mortgages are one of the most common types of loans that people borrow from financial institutes. One thing to know is that there are no restrictions on ex-pats regarding buying properties in Belgium.

However, things have taken a pretty severe turn since the financial crash. Now mortgages have in Belgium come with a fixed interest rate. Some banks across the country also offer 85% loan-to-value. Getting a home loan in Belgium is not too difficult, but finding the best deal to crack can be slightly tricky.

Some of the significant financial institutions that provide mortgages in Belgium are:

- ING Belgium

- KBC

FAQ about loans in Belgium

The overall amount of the loan borrowed by an individual depends on the financial circumstances he/she is in. For example, if you have a poor or limited credit history, you cannot borrow a higher amount.

Today different types of loans have different types of requirements; for example, if you qualify for a loan or not depend on your details and financial score. Also, you can compare the loans on the net and answer a few questions and check the interest rate before the bank accepts your application.

Loans are usually applied for several reasons. These can range from home improvements, buying a car, or getting hands-on a desirable property.

A secured loan is something that is tied to the asset you possess as security. The best example of a secured loan is a mortgage taken for buying the house.

On the other hand, an unsecured loan is the one that is given to the consumers if they have a fair credit score.